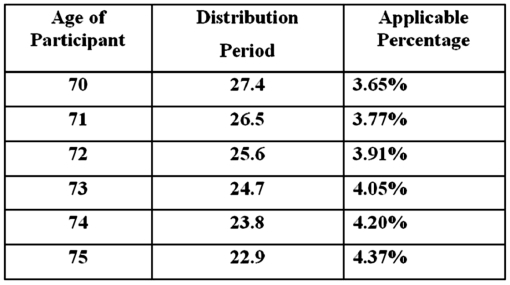

Sean (age 74 at end of 2012) retired five years ago.The balance in his 401(k) account on December 31,2012 was $1,700,000 and the balance in his account on December 31,2013 was $1,800,000.Using the IRS tables below,what is Sean's required minimum distribution for 2013?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Kathy is 60 years of age and

Q86: Which of the following taxpayers is most

Q87: Yvette is a 44-year-old self-employed contractor (no

Q88: In 2013,Ryan contributes 10 percent of his

Q89: Carmello and Leslie (ages 34 and 35,respectively)

Q90: Kathy is 60 years of age and

Q91: On March 30,2013,Rodger (age 56) was let

Q92: Amy is single.During 2013,she determined her adjusted

Q94: Amy files as a head of household.She

Q95: Gordon is a 52-year-old self-employed contractor (no

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents