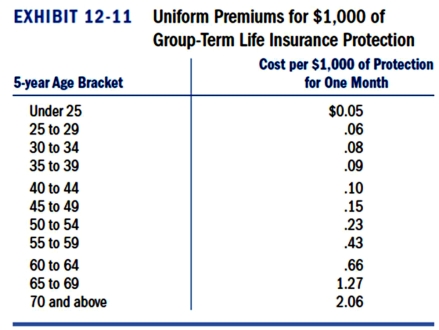

Grace's employer is now offering group-term life insurance.The company will provide each employee with $200,000 of group-term life insurance.It costs Grace's employer $700 to provide this amount of insurance to Grace each year.Assuming that Grace is 43 years old,use the table to determine the monthly premium that Grace must include in income as a result of receiving the group-term life benefit?

A) $0.

B) $15.00.

C) $22.00.

D) $58.33.$200,000 policy less $50,000 exemption times 10 cents per month per thousand of coverage.

Correct Answer:

Verified

Q67: Which of the following is not a

Q68: Which of the following is a fringe

Q69: Which of the following statements concerning cafeteria

Q70: Which of the following does not qualify

Q71: Which of the following is not an

Q73: Francis works for a local fly fishing

Q74: Which of the following is not an

Q75: Tanya's employer offers a cafeteria plan that

Q76: Which of the following statements regarding employer

Q77: Lara,a single taxpayer with a 30 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents