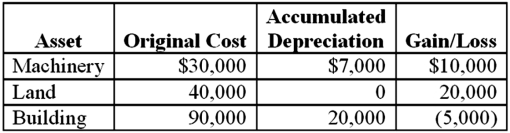

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last 5 years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

A) $25,000 ordinary income,$8,750 tax liability.

B) $25,000 §1231 gain and $3,750 tax liability.

C) $13,000 §1231 gain,$12,000 ordinary income,and $6,150 tax liability.

D) $12,000 §1231 gain,$13,000 ordinary income,and $6,350 tax liability.

E) None of thesE.Depreciation recapture of $7,000 becomes ordinary income.In addition,Brandon has a $23,000 §1231 gain and $5,000 §1231 loss,which nets to an $18,000 net §1231 gain.The 1231 lookback rule recharacterizes $5,000 of the §1231 gain to ordinary income.Thus,$12,000 (35%) of ordinary income and $13,000 (15%) of §1231 gain.The calculations results in $6,150 of tax.

Correct Answer:

Verified

Q71: Brandon,an individual,began business four years ago and

Q72: Alpha sold machinery,which it used in its

Q73: Each of the following is true except

Q74: Which one of the following is not

Q75: Mary traded furniture used in her business

Q77: Which one of the following is not

Q78: The general rule regarding the exchanged basis

Q79: Which one of the following is not

Q80: Arlington LLC traded machinery used in its

Q81: Pelosi Corporation sold a parcel of land

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents