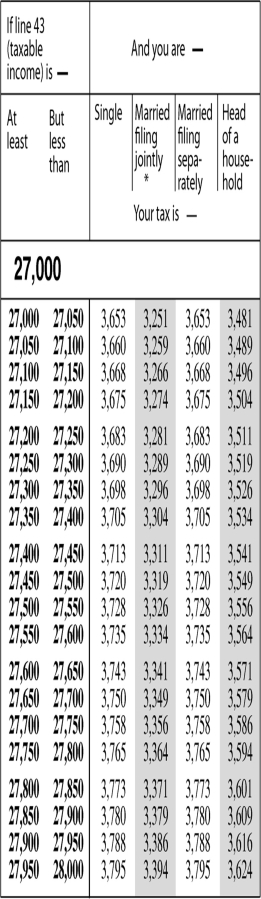

Lynn is a single mother with two children.She qualifies to file as head of household.Her total income before deductions was $38,900 last year.Her total deductions were $11,450.Her employer withheld $3,150 from her pay for tax.Use the tax table below.How much more will Lynn owe in taxes?

A) $570

B) $563

C) $407

D) $399

Correct Answer:

Verified

Q13: Janine rented an apartment for $900 a

Q14: Look at the W-2 below.What is the

Q15: A W-2 is an income statement that

Q16: John and Loretta Smith are in the

Q17: In a progressive tax system,taxes decrease as

Q19: Which statement is NOT true about the

Q20: An income tax filer who is single

Q21: Juan is a single father of 3,filing

Q22: Kathy and Jeff Miller have a combined

Q23: The tax equation for income over $74,900

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents