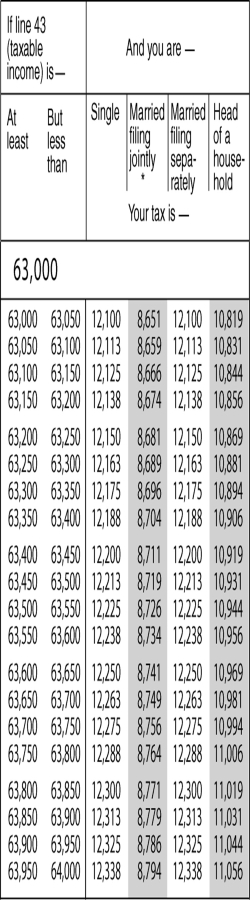

A single mother who files head of household pays a tax of $10,881.Use the table to find her taxable income interval.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Kathy and Jeff Miller have a combined

Q23: The tax equation for income over $74,900

Q24: What word is synonymous with take-home pay?

Q25: What is the term for a Wage

Q26: Abraham is a single taxpayer with no

Q28: Maria and Juan are married,filing jointly.Their taxable

Q29: Benjamin started a new job and wants

Q30: Chris's taxable income is $60,709.She is married,filing

Q31: Jason and Lina are trying to decide

Q32: Brittany's W-2 reported total Medicare withholding based

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents