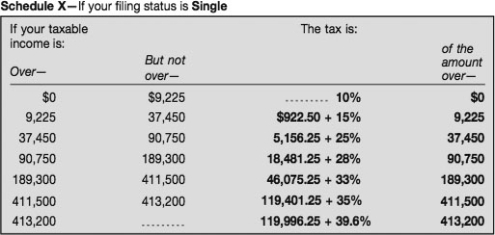

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the following tax table.What was his taxable income?

Correct Answer:

Verified

Q29: Benjamin started a new job and wants

Q30: Chris's taxable income is $60,709.She is married,filing

Q31: Jason and Lina are trying to decide

Q32: Brittany's W-2 reported total Medicare withholding based

Q33: Tanika is filing single and has a

Q35: Nancy does her taxes herself.She filled out

Q36: Asa is single and had taxable income

Q37: Jennifer and Ken Citizen have a combined

Q38: Angela's effective federal tax rate is 17%.Last

Q39: Lisa is a single taxpayer whose total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents