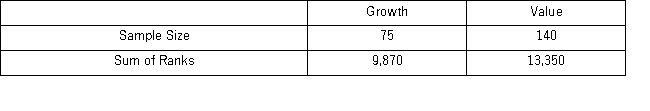

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the critical value approach and α = 0.01,the appropriate conclusion is ____________.

Using the critical value approach and α = 0.01,the appropriate conclusion is ____________.

A) reject the null hypothesis;conclude the median return of growth stock is greater than the median return of value stocks

B) do not reject the null hypothesis;conclude the median return of value stock is greater than the median return of growth stocks

C) do not reject the null hypothesis;conclude the median return of growth stock differs from the median return of value stocks

D) reject the null hypothesis;we cannot conclude the median return of growth stocks is greater than the median return of value stocks

Correct Answer:

Verified

Q68: Investment institutions usually have funds with different

Q70: A fund manager wants to know if

Q71: SHY (NYSEARCA: SHY)is a 1−3 year Treasury

Q72: A marketing firm needs to replace its

Q73: A marketing firm needs to replace its

Q74: A fund manager wants to know if

Q76: A fund manager wants to know if

Q77: A fund manager wants to know if

Q78: An accountant wants to know if the

Q79: An accountant wants to know if the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents