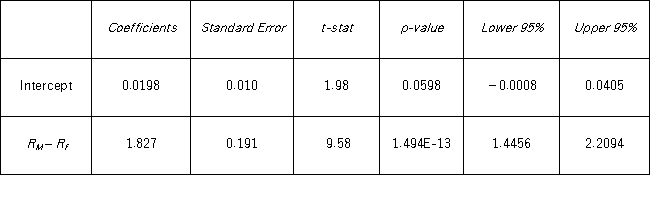

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the capital asset pricing model (CAPM) model for Tiffany's return.  You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses: __________________.

You would like to determine whether an investment in Tiffany's is riskier than the market.When conducting this test,you set up the following competing hypotheses: __________________.

A) H0:α = 0;HA:α ≠ 0

B) H0:β = 0;HA:β ≠ 0

C) H0:α ≤ 1;HA:α >0

D) H0:β ≤ 1;HA:β >1

Correct Answer:

Verified

Q52: Serial correlation occurs when the error term

Q60: A marketing analyst wants to examine the

Q61: A researcher analyzes the factors that may

Q62: A researcher analyzes the factors that may

Q63: The accompanying table shows the regression results

Q65: A researcher analyzes the factors that may

Q66: A researcher analyzes the factors that may

Q67: The accompanying table shows the regression results

Q68: A researcher analyzes the factors that may

Q69: Tiffany & Co.has been the world's premier

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents