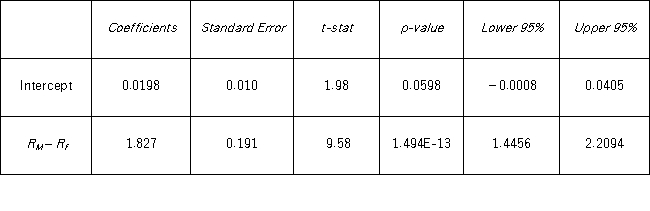

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

A) H0:α = 0;HA:α ≠ 0

B) H0:β = 0;HA:β ≠ 0

C) H0:α ≤ 1;HA:α > 1

D) H0:β ≤ 1;HA:β > 1

Correct Answer:

Verified

Q74: The accompanying table shows the regression results

Q75: Tiffany & Co.has been the world's premier

Q76: A researcher analyzes the factors that may

Q77: A researcher analyzes the factors that may

Q78: A researcher analyzes the factors that may

Q80: A manager at a local bank analyzed

Q81: An economist estimates the following model:y =

Q82: A real estate analyst believes that the

Q83: A researcher studies the relationship between SAT

Q117: Which of the following can be used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents