Exhibit 21-2

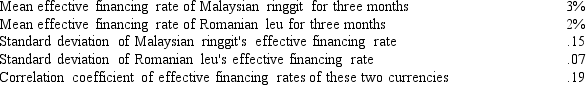

Moore Corporation would like to simultaneously invest in Malaysian ringgit (MYR) and Romanian leu (ROL) for a three-month period. Moore would like to determine the expected yield and the variance of a portfolio consisting of 40% ringgit and 60% leu. Moore has identified the following information:

-Refer to Exhibit 21-2. What is the standard deviation of the portfolio contemplated by Moore Corporation?

A) .624%.

B) 7.950%.

C) 1.040%.

D) 10.200%.

E) none of the above

Correct Answer:

Verified

Q10: If a foreign currency consistently depreciated against

Q10: Since exchange rate forecasts are not always

Q12: Although netting typically increases the need for

Q16: Since each subsidiary may be more concerned

Q21: _ may complicate cash flow optimization.

A)The use

Q22: Assume that interest rate parity holds. The

Q25: Leading refers to the payment of supplies

Q27: Exhibit 21-2

Moore Corporation would like to simultaneously

Q28: Bullock Corporation invests 1,500,000 South African rand

Q42: Assume that in recent months, most currencies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents