Exhibit 14-1 Assume That Baps Corporation Is Considering the Establishment of a of a Subsidiary

Exhibit 14-1

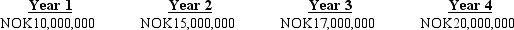

Assume that Baps Corporation is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5,000,000. If the project is undertaken, Baps would terminate the project after four years. Baps' cost of capital is 13%, and the project is of the same risk as Baps' existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

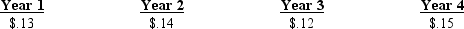

The current exchange rate of the Norwegian kroner is $.135. Baps' exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below:

The current exchange rate of the Norwegian kroner is $.135. Baps' exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below:

-Refer to Exhibit 14-1. Assume that NOK8,000,000 of the cash flow in year 4 represents the salvage value. Baps is not completely certain that the salvage value will be this amount and wishes to determine the break-even salvage value, which is $____.

A) 510,088.04

B) 1,710,088

C) 1,040,000

D) none of the above

Correct Answer:

Verified

Q22: Everything else being equal, the _ the

Q25: If an MNC sells a product in

Q26: Exhibit 14-1

Assume that Baps Corporation is considering

Q27: Exhibit 14-1

Assume that Baps Corporation is considering

Q28: A U.S.-based MNC has just established a

Q30: When a foreign subsidiary is not wholly

Q33: One foreign project in Hungary and another

Q34: An international project's NPV is _ related

Q35: Which of the following is not a

Q55: Like income tax treaties, _ help to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents