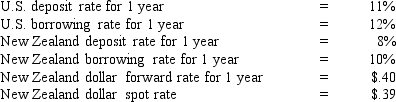

Assume the following information:  Also assume that a U.S. exporter denominates its New Zealand exports in NZ$ and expects to receive NZ$600,000 in 1 year. You are a consultant for this firm.

Also assume that a U.S. exporter denominates its New Zealand exports in NZ$ and expects to receive NZ$600,000 in 1 year. You are a consultant for this firm.

Using the information above, what will be the approximate value of these exports in 1 year in U.S. dollars given that the firm executes a money market hedge?

A) $238,584.

B) $240,000.

C) $234,000.

D) $236,127.

Correct Answer:

Verified

Q12: Assume that Parker Company will receive SF200,000

Q13: Which of the following reflects a hedge

Q14: The real cost of hedging payables with

Q17: Use the following information to calculate the

Q19: If interest rate parity exists and transactions

Q20: If Salerno Inc. desired to lock in

Q45: Your company will receive C$600,000 in 90

Q50: Foghat Co. has 1,000,000 euros as receivables

Q54: Assume zero transaction costs. If the 90-day

Q59: Assume zero transaction costs. If the 180-day

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents