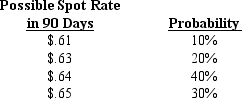

Assume that Kramer Co. will receive SF800,000 in 90 days. Today's spot rate of the Swiss franc is $.62, and the 90-day forward rate is $.635. Kramer has developed the following probability distribution for the spot rate in 90 days:  The probability that the forward hedge will result in more dollars received than not hedging is:

The probability that the forward hedge will result in more dollars received than not hedging is:

A) 10%.

B) 20%.

C) 30%.

D) 50%.

E) 70%.

Correct Answer:

Verified

Q26: A forward contract hedge is very similar

Q27: When a perfect hedge is not available

Q28: If interest rate parity exists, and transaction

Q32: Lorre Company needs 200,000 Canadian dollars (C$)

Q35: Quasik Corporation will be receiving 300,000 Canadian

Q36: Which of the following is the least

Q38: Assume that Patton Co. will receive 100,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents