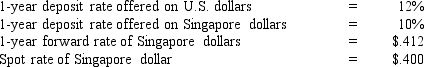

Assume the following information: U.S. investors have $1,000,000 to invest: Given this information:

Given this information:

A) interest rate parity exists and covered interest arbitrage by U.S. investors results in the same yield as investing domestically.

B) interest rate parity doesn't exist and covered interest arbitrage by U.S. investors results in a yield above what is possible domestically.

C) interest rate parity exists and covered interest arbitrage by U.S. investors results in a yield above what is possible domestically.

D) interest rate parity doesn't exist and covered interest arbitrage by U.S. investors results in a yield below what is possible domestically.

Correct Answer:

Verified

Q6: Assume the following bid and ask rates

Q7: Assume that the U.S. investors are benefiting

Q8: Assume that the interest rate in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents