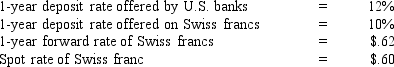

Assume the following information: U.S. investors have $1,000,000 to invest: Given this information:

Given this information:

A) interest rate parity exists and covered interest arbitrage by U.S. investors results in the same yield as investing domestically.

B) interest rate parity doesn't exist and covered interest arbitrage by U.S. investors results in a yield above what is possible domestically.

C) interest rate parity exists and covered interest arbitrage by U.S. investors results in a yield above what is possible domestically.

D) interest rate parity doesn't exist and covered interest arbitrage by U.S. investors results in a yield below what is possible domestically.

Correct Answer:

Verified

Q30: Assume that interest rate parity holds, and

Q31: Assume that the euro's interest rates are

Q32: Assume the following information for a bank

Q33: Assume the U.S. interest rate is 2%

Q37: Assume the British pound is worth $1.60,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents