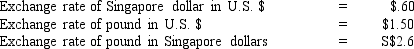

Assume the following information for a bank quoting on spot exchange rates:  Based on the information given, as you and others perform triangular arbitrage, what should logically happen to the spot exchange rates?

Based on the information given, as you and others perform triangular arbitrage, what should logically happen to the spot exchange rates?

A) The Singapore dollar value in U.S. dollars should appreciate, the pound value in U.S. dollars should appreciate, and the pound value in Singapore dollars should depreciate.

B) The Singapore dollar value in U.S. dollars should depreciate, the pound value in U.S. dollars should appreciate, and the pound value in Singapore dollars should depreciate.

C) The Singapore dollar value in U.S. dollars should depreciate, the pound value in U.S. dollars should appreciate, and the pound value in Singapore dollars should appreciate.

D) The Singapore dollar value in U.S. dollars should appreciate, the pound value in U.S. dollars should depreciate, and the pound value in Singapore dollars should appreciate.

Correct Answer:

Verified

Q17: Assume that Swiss investors are benefiting from

Q19: When using _, funds are not tied

Q24: Assume the following information: Q27: Which of the following is an example Q27: Assume the following information: You have $1,000,000 Q33: You just received a gift from a Q36: Assume the bid rate of a Swiss Q52: Assume the bid rate of a New Q58: Due to _, market forces should realign Q62: Assume the following exchange rates: $1 =![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents