Multiple Choice

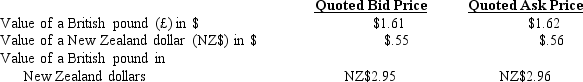

National Bank quotes the following for the British pound and the New Zealand dollar:  Assume you have $10,000 to conduct triangular arbitrage. What is your profit from implementing this strategy?

Assume you have $10,000 to conduct triangular arbitrage. What is your profit from implementing this strategy?

A) $77.64.

B) $197.53.

C) $15.43.

D) $111.80.

Correct Answer:

Verified

Related Questions

Q10: If interest rate parity (IRP) exists, then

Q17: Assume locational arbitrage is possible and involves

Q19: For locational arbitrage to be possible, one

Q37: Assume the British pound is worth $1.60,

Q39: To capitalize on high foreign interest rates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents