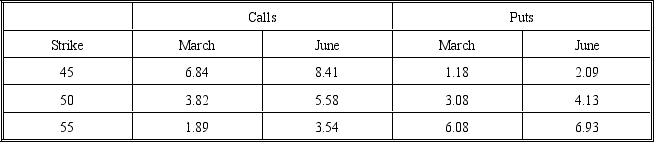

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

For questions 7 and 8, suppose an investor expects the stock price to remain at about $50 and decides to execute a butterfly spread using the June calls.

-What will be the cost of the butterfly spread?

A) $1,195

B) $637

C) $79

D) $1,045

E) none of the above

Correct Answer:

Verified

Q3: The following prices are available for call

Q4: The following prices are available for call

Q5: The following prices are available for call

Q6: The following prices are available for call

Q7: The following prices are available for call

Q9: The following prices are available for call

Q10: The following prices are available for call

Q11: The following prices are available for call

Q12: The following prices are available for call

Q13: The following prices are available for call

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents