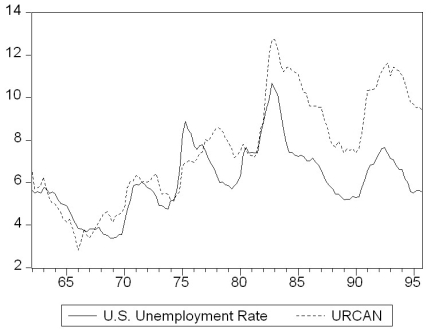

There is some evidence that the Phillips curve has been unstable during the 1962 to 1999 period for the United States,and in particular during the 1990s.You set out to investigate whether or not this instability also occurred in other places.Canada is a particularly interesting case,due to its proximity to the United States and the fact that many features of its economy are similar to that of the U.S.

(a)Reading up on some of the comparative economic performance literature,you find that Canadian unemployment rates were roughly the same as U.S.unemployment rates from the 1920s to the early 1980s.The accompanying figure shows that a gap opened between the unemployment rates of the two countries in 1982,which has persisted to this date.  Inspection of the graph and data suggest that the break occurred during the second quarter of 1982.To investigate whether the Canadian Phillips curve shows a break at that point,you estimate an ADL(4,4)model for the sample period 1962:I-1999:IV and perform a Chow test.Specifically you postulate that the constant and coefficients of the unemployment rates changed at that point.The F-statistic is 1.96.Find the critical value from the F-table and test the null hypothesis that a break occurred at that time.Is there any reason why you should be skeptical about the result regarding the break and using the Chow-test to detect it?

Inspection of the graph and data suggest that the break occurred during the second quarter of 1982.To investigate whether the Canadian Phillips curve shows a break at that point,you estimate an ADL(4,4)model for the sample period 1962:I-1999:IV and perform a Chow test.Specifically you postulate that the constant and coefficients of the unemployment rates changed at that point.The F-statistic is 1.96.Find the critical value from the F-table and test the null hypothesis that a break occurred at that time.Is there any reason why you should be skeptical about the result regarding the break and using the Chow-test to detect it?

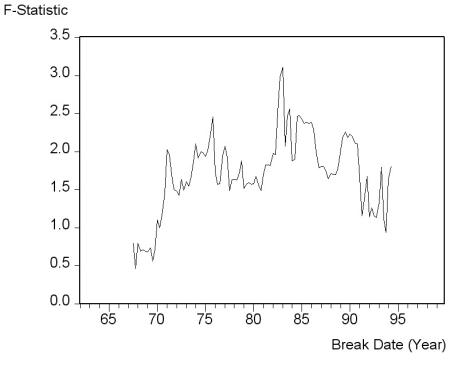

(b)You consider alternative ways to test for a break in the relationship.The accompanying figure shows the F-statistics testing for a break in the ADL(4,4)equation at different dates.  The QLR-statistic with 15% trimming is 3.11.Comment on the figure and test for the hypothesis of a break in the ADL(4,4)regression.

The QLR-statistic with 15% trimming is 3.11.Comment on the figure and test for the hypothesis of a break in the ADL(4,4)regression.

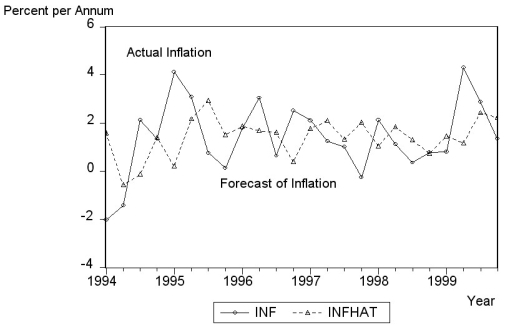

(c)To test for the stability of the Canadian Phillips curve in the 1990s,you decide to perform a pseudo out-of-sample forecasting.For the 24 quarters from 1994:I-1999:IV you use the ADL(4,4)model to calculate the forecasted change in the inflation rate,the resulting forecasted inflation rate,and the forecast error.The standard error of the ADL(4,4)for the estimation sample period 1962:1-1993:4 is 1.91 and the sample RMSFE is 1.70.The average forecast error for the 24 inflation rates is 0.003 and the sample standard deviation of the forecast errors is 0.82.Calculate the t-statistic and test the hypothesis that the mean out-of-sample forecast error is zero.Comment on the result and the accompanying figure of the actual and forecasted inflation rate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: You should use the QLR test for

Q23: If a "break" occurs in the population

Q29: The textbook displayed the accompanying four economic

Q29: (Requires Internet access for the test question)

The

Q32: (Requires Appendix material)Define the difference operator Δ

Q35: The AIC is a statistic

A)that is used

Q36: You set out to forecast the unemployment

Q37: The formulae for the AIC and the

Q38: Statistical inference was a concept that was

Q39: The Bayes-Schwarz Information Criterion (BIC)is given by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents