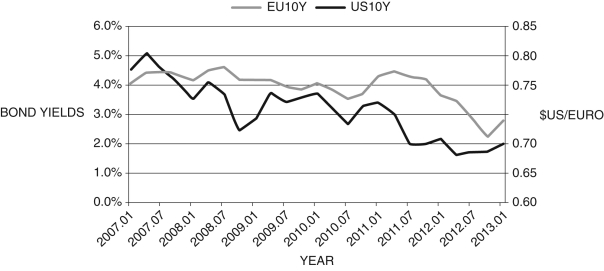

Figure 20.7 shows 10-year bond yields for the euro area countries (EU10Y) and the United States (US10Y) between 2007 and 2012. Given the data, what does the short-run nominal exchange rates model suggest should happen to the dollar-euro exchange rate? What other factor(s) might affect the exchange rate other than bond yields?Figure 20.7: Euro and U.S. Bond Yields

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q132: Under the Bretton Woods standard, the dollar

Q133: Figure 20.9: Dollar-Euro Exchange Rate

Q134: During the 1990s, the Yugoslavian countries of

Q135: The U.S. dollar would appreciate if

Q136: With the foreign interest rate in the

Q137: In the years prior to the Argentinean

Q139: The value of the exchange rate matters

Q140: In the long run, what value should

Q141: One impact of the Southeast Asian crisis

Q142: Despite the European Central Bank's (ECB) hawkish

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents