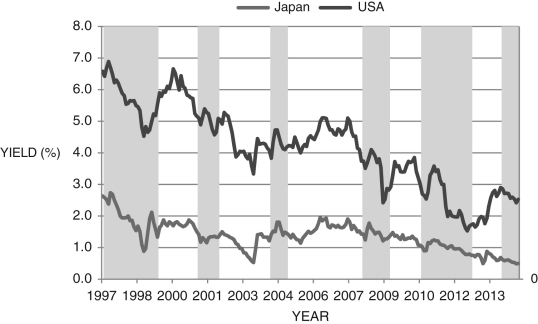

Figure 18.4 below shows bond yields on U.S., Japanese, and German 10-year bonds, 1997-2014. The gray shaded areas represent Japanese recession dates. During this period the U.S. had two official recessions: one in 2001 and one from 2008-2009. Given this information and what you know about Japanese and American debt-to-GDP ratios, explain the reason(s) for the differences in Japanese and American bond yields.Figure 18.4: Japan and USA 10-Year Bond Yields and Japanese Recession Dates: 1997-2014

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: The national income identity can be rearranged

Q111: According to the law of diminishing returns,

Q112: Argentina, Mexico, and Brazil have all defaulted

Q113: Write down the government's budget constraint. Be

Q114: We can compensate future generations for the

Q116: If a government has a difficult time

Q117: In 1956, the Federal-Aid Highway Act of

Q118: What is Norway's debt-to-GDP situation? Why? Given

Q119: Figure 18.5 below shows German and Italian

Q120: During which period did the United States

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents