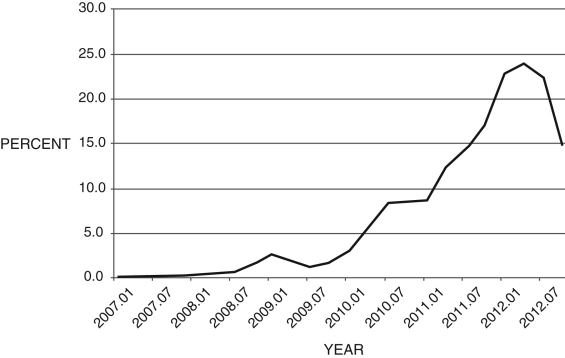

Figure 15.7 shows the difference between Greek and German 10-year bond yields from 2007-2013. Answer the following questions:

(a) What does this data represent?

(b) In the Smets-Wouters DSGE model, what type of shock is this?

(c) How does this shock affect the macroeconomy in the Smets-Wouters DSGE model? Explain.Figure 15.7: 10-Year Bond Yields: Greece minus Germany

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: In 2003, Ireland reduced its corporate tax

Q110: In the stylized DSGE model with sticky

Q111: You are presented with the following data,

Q112: With a nominal price rigidity, firms cannot

Q113: A new colleague of yours decided to

Q115: Inflation falls following the introduction of a

Q116: In 2013, there were numerous global conflicts:

Q117: Consider the impulse response functions generated using

Q118: In December 2010, Congress and President Obama

Q119: In the Smets-Wouters DSGE model, a positive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents