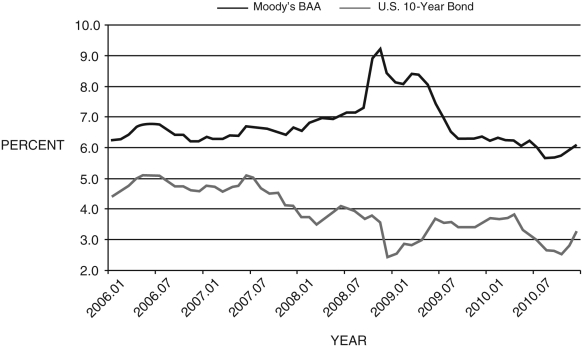

Figure 14.5: Moody's Corporate BAA and 10-Year U.S. Bond Yields  (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Consider Figure 14.5 to answer the following questions.

(a) What is the difference between the two yields? Explain.

(b) What caused the sharp divergence between these two yields in late 2008? Explain.

(c) Explain the dynamics of the decline in 10-year bond yield and the increases in the BAA

bond yield during that time.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: The financial friction raises the borrowing rate

Q97: The relatively high growth rate of money

Q98: According to Federal Reserve Bank of Minneapolis

Q99: When a financial friction is added to

Q100: The burst of the housing bubble can

Q102: Between January 1985 and January 1990, the

Q103: The following statement is from the October

Q104: Briefly discuss the Fed's balance sheet before

Q105: The Fed's holdings of mortgage-backed securities is

Q106: You are a newly hired reporter for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents