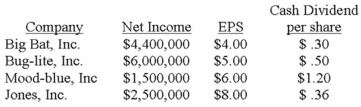

Blair Wilson is planning to invest in one of the following companies based on their average performance over the past five years, summarized below.  If Blair is looking for a company that is likely to achieve rapid growth in revenues and profitability, which one should he choose?

If Blair is looking for a company that is likely to achieve rapid growth in revenues and profitability, which one should he choose?

A) Big Bat, Inc.

B) Bug-lite, Inc.

C) Mood-blue, Inc.

D) Jones, InC.The higher earnings per share of Jones, Inc. indicates that the market predicts future growth in revenues and profitability.

Correct Answer:

Verified

Q79: The declaration and issuance of a stock

Q80: Calculate the number of shares outstanding after

Q81: Frost Corporation reported net income of $65,000

Q82: The stock of Big Oil Co. was

Q83: On June 10, 2013, Miller Builders, Inc.,

Q85: Gravely Co. declared a 2-for-1 stock split.

Q86: The price-earnings ratio is calculated as:

A)The market

Q87: Coleman Co. purchased 500 shares of its

Q88: Mary Brown, who had held 12% of

Q89: Santino Co. declared a cash dividend but

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents