The Ballard-Frye partnership was formed on January 1, 2013, when Ballard and Frye invested $80,000 and $60,000 cash in the partnership, respectively. During 2013, the partnership earned $150,000 in cash revenues and paid $104,000 in cash expenses. Ballard withdrew $10,000 cash from the business during the year, and Frye withdrew $8,000. The partnership agreement specified that net income should be allocated equally to the partners' capital accounts.

Required:

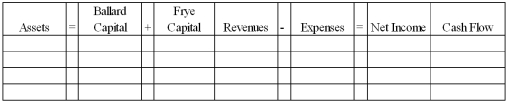

Indicate how each of the transactions and events for the Ballard-Frye partnership affects the financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, indicate whether each is an operating activity (OA), investing activity (IA), or financing activity (FA). Indicate NA if an element is not affected by a transaction.

Correct Answer:

Verified

Q131: A sole proprietorship was established on January

Q132: Schultz Corp. has the following number of

Q133: Indicate whether each of the following statements

Q134: A sole proprietorship was formed on January

Q135: Indicate whether each of the following statements

Q137: The Carson-Newman partnership was formed on January

Q138: The Creighton Company was started on January

Q139: The following items appeared on the financial

Q140: Indicate whether each of the following statements

Q141: Prepare journal entries for the following transactions.

a)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents