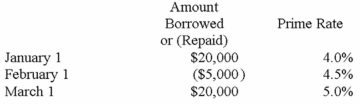

Ferguson Company obtained an $80,000 line of credit from the Metropolitan Bank on January 1, 2013. The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate. The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of 2013 are shown in the following table. Assume that Ferguson borrows or repays on the first day of each month. Borrowing is shown as a positive amount and repayments are shown as negative amounts indicated by parentheses.  Based on this information alone, the amount of interest expense recognized for the month of March would be:

Based on this information alone, the amount of interest expense recognized for the month of March would be:

A) $116.

B) $131.

C) $146.

D) $204.

Correct Answer:

Verified

Q45: Bonds payable are usually classified on the

Q46: Which of the following is not a

Q47: Parsons Company issued at 97 bonds with

Q48: The Barden Company called in bonds at

Q49: The total amount of liabilities shown on

Q51: Madison Company issues $12,500 of bonds at

Q52: Bonds that mature at specified intervals throughout

Q53: Burton Company issued bonds with a face

Q54: Wayne Company issued $20,000 of callable bonds

Q55: Unsecured bonds are called:

A)debenture bonds.

B)coupon bonds.

C)discount bonds.

D)par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents