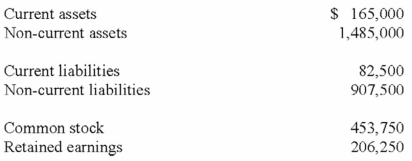

Garza, Inc. and Marx, Inc. each had the same financial position on 1/1/13. The following is a summary of each of their balance sheets as of 1/1/13:  Garza is about to raise $200,000 in cash by issuing bonds. Marx is going to raise $200,000 on the same day by issuing common stock. Immediately after these transactions, which of the following statements will be correct?

Garza is about to raise $200,000 in cash by issuing bonds. Marx is going to raise $200,000 on the same day by issuing common stock. Immediately after these transactions, which of the following statements will be correct?

A) Garza's current ratio will be higher than Marx's.

B) Garza's current ratio will be lower than Marx's.

C) Garza's debt to asset ratio will be higher than Marx's.

D) Garza's debt to asset ratio will be lower than Marx's.

Correct Answer:

Verified

Q86: The amount of cash flow from operating

Q87: On December 31, 2013, Crown Co. paid

Q88: The amount of interest expense appearing on

Q89: Which of the following conditions indicate a

Q90: Assuming Wagoner issued the bond for $215,970,

Q92: Terra Company reported income before taxes of

Q94: The times-interest-earned ratio is calculated by which

Q95: On January 1, 2013 Bluefield Co. issued

Q96: If Winfield issued the bonds for 96,

A)the

Q98: Straight-line interest amortization of a premium or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents