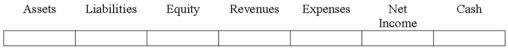

Peyton Company sold merchandise to a customer for $880 cash in a state where the sales tax rate is 5%. (Ignore the effect of cost of goods sold.)

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: When is warranty expense usually recognized?

Q35: Why does the recording of a taxable

Q94: On April 1, 2014, Jordan Company repaid

Q95: Kirk Co. sells goods to customers with

Q96: How do the issuance of a note

Q97: Peyton Company made its remittance to the

Q98: Joseph Company issued a one-year, 6% note

Q100: Chenowith Company recognized payroll tax expense for

Q101: Indicate whether each of the following statements

Q102: What type of account is Discount on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents