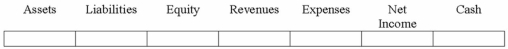

Kirk Co. sells goods to customers with a three-year warranty. During 2012, Kirk sold $500,000 of goods. On December 31, 2012, Kirk made the appropriate year-end adjustment to record the warranty expense related to the goods sold during the year. During 2013, Kirk paid $400 cash to satisfy warranty claims. Show the effects of the 2012 adjustment to record warranty expense.

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Albertson Co. purchased a $3,000 machine by

Q91: Wilson Company issued a $33,000, 8% note

Q92: On December 31, 2013, Weston Co. recognized

Q93: Kirk Co. sells goods to customers with

Q94: On April 1, 2014, Jordan Company repaid

Q96: How do the issuance of a note

Q97: Peyton Company made its remittance to the

Q98: Joseph Company issued a one-year, 6% note

Q99: Peyton Company sold merchandise to a customer

Q100: Chenowith Company recognized payroll tax expense for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents