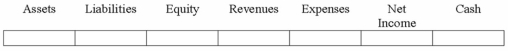

The Blosser Company purchased an asset on January 1, 2013 for $100,000. The asset had a $25,000 salvage value and a 10 year life. The asset was sold on January 1, 2015 for $82,000. Show how the sale will affect Blosser's financial statements, assuming that Blosser uses straight-line depreciation.

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: What is meant by a "basket purchase,"

Q6: Give an example of an intangible asset

Q14: Why is land classified separately from other

Q18: What items are included in the cost

Q98: Which of the following assets is not

Q99: Banks Company recognized $3,000 of depreciation expense

Q100: The Grant Company purchased the Lee Company

Q102: The Blackwell Company purchased an asset for

Q105: The Gray Company purchased equipment on account

Q106: Bruen Company amortized $3,400 of patent cost.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents