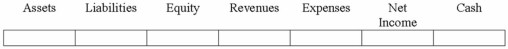

The Byer Company purchased the Cellar Company for $550,000 cash. Cellar's assets had been appraised at $560,000. At the time of sale Cellar's accounting records showed total assets of $490,000, liabilities of $80,000 and equity of $410,000. How would the purchase affect Byer's financial statements?

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Name three examples of property,plant and equipment.

Q11: What type of account is Accumulated Depreciation?

Q12: Explain how the gain or loss is

Q20: Which method of depreciation generally allocates the

Q32: What is the name of the tax

Q110: On May 16, 2013, Twin Peaks Corporation

Q112: An asset purchased for $12,000 with a

Q113: The Baird Company paid $4,500 to extend

Q116: The Jenkins Company purchased equipment for $15,000

Q118: Offshore Oil Company recognized $3,000,000 of depletion

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents