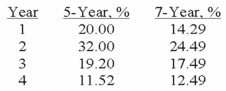

The Garcia Corporation purchased $40,000 of equipment on July 1, 2013. The equipment is expected to be used in the business for five years and has an estimated salvage value of $5,500. Partial MACRS tables are listed below:  Required:

Required:

a) Compute the amount of depreciation that is deductible under MACRS for 2013 and 2014 assuming that the equipment is classified as 5-year property.

b) Compute the amount of depreciation that is deductible under MACRS for 2013 and 2014 assuming that the equipment is classified as 7-year property.

Correct Answer:

Verified

2013 $8...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: In 2013, Rocky Mountain Mining Co. purchased

Q143: On January 2, 2013, Preston Corporation purchased

Q144: On January 1, 2013, Flintstone Company purchased

Q145: Indicate whether each of the following statements

Q146: The Bugs Company purchased the Daffy Company

Q148: On May 4, 2013, Strauss Company purchased

Q149: On January 1, 2013, Scott Corporation purchased

Q150: On January 1, 2013, Goldberg Company purchased

Q151: Indicate whether each of the following statements

Q152: On January 1, 2013, Juniper Manufacturing Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents