On January 1, 2013, the Daley Corporation paid $9,000 for major improvements on a two-year-old manufacturing machine. Although the expenditure did not change the expected useful life, it greatly increased the productivity of the machine. Prior to this transaction, the machine account in the general ledger was listed at $42,000, and the accumulated depreciation account was $10,000. Daley uses the straight-line depreciation method. The estimated useful life was six years, and the estimated salvage value was $2,000.

Required:

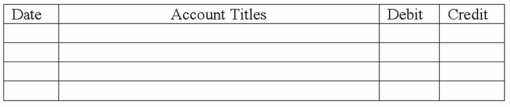

a) Prepare the entry in general journal form for the January 1, 2013 transaction.  b) Immediately after the January 1, 2013 transaction, what is the book value of the asset on Daley books?

b) Immediately after the January 1, 2013 transaction, what is the book value of the asset on Daley books?

c) Compute the depreciation for the machine for December 31, 2013.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q149: On January 1, 2013, Scott Corporation purchased

Q150: On January 1, 2013, Goldberg Company purchased

Q151: Indicate whether each of the following statements

Q152: On January 1, 2013, Juniper Manufacturing Company

Q153: Sinclair Company purchased a new machine on

Q154: Sturgis Corporation purchased equipment on January 2,

Q156: In 2013, Harrogate Corporation Co. acquired a

Q157: Michigan Corporation purchased a new truck on

Q158: Old MacDonald Corporation purchased for $440,000 land

Q159: In January 2013, Rogers Co. purchased a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents