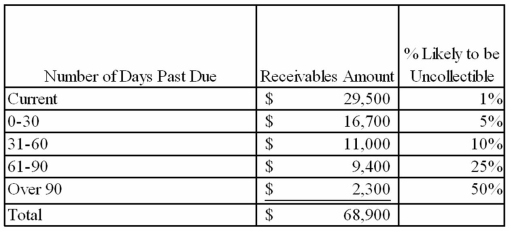

Barnes Corporation uses the percent of receivables method of accounting for uncollectible accounts. As of December 31, 2013, prior to estimating uncollectible accounts expense, Barnes's balance of accounts receivable was $68,900, the balance of allowance for doubtful accounts was $2,500, and total credit sales for 2013 were $875,000. On December 31, Barnes aged its receivables and determined the following:  Indicate whether each of the following statements is true or false.

Indicate whether each of the following statements is true or false.

_____ a) Barnes will report Net Realizable Value of Accounts Receivable equal to $63,170 on its December 31, 2013 balance sheet.

_____ b) Barnes will report Uncollectible Accounts Expense of $5,730 on its 2013 income statement.

_____ c) The December 31 adjusting entry related to uncollectible accounts will decrease assets and equity by $3,230.

_____ d) The method Barnes uses to account for uncollectible accounts is known as the balance sheet approach.

_____ e) Write-offs of uncollectible accounts in 2014 will reduce Barnes' net realizable value of receivables.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: What type of transaction is the write-off

Q27: How is the number of days to

Q32: Explain the computation of the length of

Q36: What is the effect on the accounting

Q99: Lowe Company has the following account balances:

Q100: On November 1, 2013, Gannon Company accepted

Q103: If Kane Company loans $6,000 to Bowen

Q105: Indicate whether each of the following statements

Q106: One of the methods of accounting for

Q109: Indicate whether each of the following statements

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents