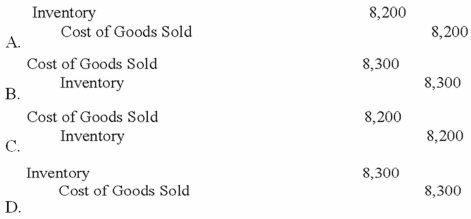

Torres Company purchased 2,000 units of inventory that cost $2.00 each on January 1, 2013. An additional 3,000 units of inventory were purchased on January 12, 2013 at a cost of $2.10 each. Torres Company sold 4,000 units of inventory on January 20, 2013. Which of the following entries would be required to recognize the cost of goods sold assuming that Torres Co. uses the perpetual inventory method and a FIFO cost flow method?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q50: Maddox Company uses the perpetual inventory method.

Q51: Which of the following businesses is most

Q52: Assuming Chandler uses a FIFO cost flow

Q53: Determine the amount of ending inventory assuming

Q54: Determine the amount of cost of goods

Q56: The lower-of-cost-or-market rule can be applied to

A)major

Q57: Kitchen Company uses the perpetual inventory method.

Q58: Reichart Company has four different categories of

Q59: Signal Company uses the perpetual inventory method.

Q60: Greene's ending inventory under LIFO would be:

A)$910.

B)$820.

C)$740.

D)$650.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents