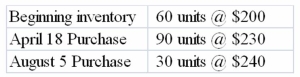

During November 2013, Cortez Company sold 125 units @ $450 each. Cash selling and administrative expenses for the year were $22,000. All transactions were cash transactions. The following information is also available:  The company's income tax rate is 30%.

The company's income tax rate is 30%.

Required:

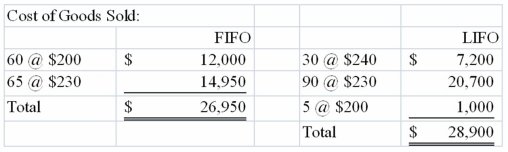

a) Prepare an income statement for Cortez Company for 2013 assuming:

1) FIFO inventory cost flow

2) LIFO inventory cost flow

b) Prepare the operating activities section of the statement of cash flows for 2013 assuming:

1) FIFO inventory cost flow

2) LIFO inventory cost flow

Correct Answer:

Verified

1)

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: If some inventory items have declined in

Q23: Discuss the significance of the average number

Q119: Sandridge Company uses the weighted average inventory

Q121: Cho Co. sells product

A. The beginning inventory

Q122: Jenkins Company sells home weather exercise bikes.

Q124: The Darden Company had its entire inventory

Q125: Duffy Company's first year in operation was

Q126: Kurtz Company has provided the following figures

Q127: Ireland Corporation's ending inventory as of December

Q128: The accountant for the Balboa Company made

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents