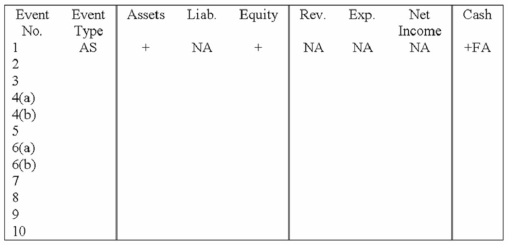

Adirondack Outdoor Supply, which uses the perpetual inventory system, experienced the following events during June 2013.

1. Issued common stock for cash.

2. Purchased inventory on account, terms 2/10, n/30, FOB shipping point.

3. Paid the shipping charges on the purchase in event #2.

4. Sold merchandise to a customer on account, terms 2/10, n/30, FOB destination. Record the revenue recognition as 4(a) and the expense recognition as 4(b).

5. Paid the shipping charges on goods sold in event #4.

6. Customer returned some of the merchandise sold in event #4. Record the effect on revenue as 6(a) and the effect on expenses as 6(b).

7. Recorded discount granted to the customer in event #4.

8. Recorded payment received from the customer in event #4.

9. Recorded discount received on purchase in event #2.

10. Recorded payment of amount due on purchase in event #2.

Required:

Identify each event as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explain how each event affects the financial statements by placing a + for increase, - for decrease, or NA for not affected under each of the components of the following statements model. Also, indicate in the cash column if the event would be recorded as an operating activity (OA), an investing activity (IA) or a financing activity (FA). The first event is recorded as an example.

Correct Answer:

Verified

Q28: What type of financial statement matches sales

Q39: Discuss the major differences between a perpetual

Q109: Indicate whether each of the following statements

Q118: Indicate whether each of the following statements

Q138: Indicate whether each of the following statements

Q140: Why are cash discounts given, and who

Q142: Patty's Pet Shop had the following transactions

Q143: The 2013 income statements for the Alpha

Q144: The following events pertain to Happy Acres

Q145: The following is a list of selected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents