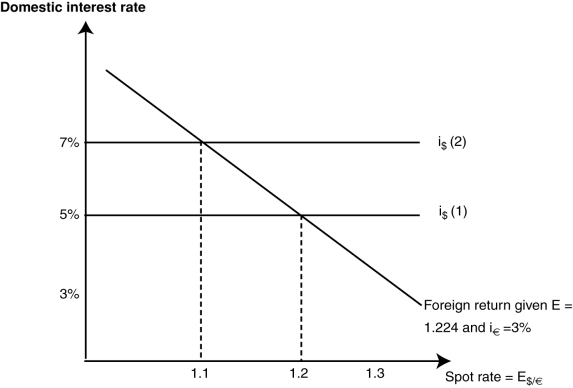

(Figure: The Domestic Interest Rate) Using the graph, if the expected future exchange rate falls from $1.224 to $1.15:

A) the dollar interest rate line shifts up and the spot rate rises.

B) the dollar interest rate line shifts down and the spot rate rises.

C) the foreign return line shifts up and to the right and the spot rate rises.

D) the foreign return line shifts down and to the left and the spot rate falls.

Correct Answer:

Verified

Q23: When expected dollar-euro exchange rates rise, the

Q24: The money market (short-run) equilibrium equation states

Q25: If the spot exchange rate is undervalued,

Q26: If the U.S. interest rate is 9%

Q27: We assume flexible prices in the long

Q29: Using the UIP equation, what would happen

Q30: Using the UIP equation, equilibrium in the

Q31: (Figure: The Domestic Interest Rate) Using the

Q32: The asset approach to short-run exchange rate

Q33: Using the UIP equation, what would happen

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents