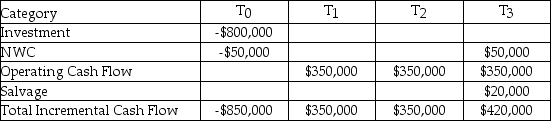

Your firm has an average-risk project under consideration.You choose to fund the project in the same manner as the firm's existing capital structure.If the cost of debt is 9.50%,the cost of preferred stock is 10.00%,the cost of common stock is 12.00%,and the WACC adjusted for taxes is 11.50%,what is the IRR of the project,given the expected cash flows listed here? Use a financial calculator to determine your answer.

A) About 11.50%

B) About 28.30%

C) About 14.67%

D) There is not enough information to answer this question.

Correct Answer:

Verified

Q49: When calculating the after-tax weighted average cost

Q59: The following information comes from the balance

Q63: The following market information was gathered for

Q65: Takelmer Industries has a different WACC for

Q66: Your firm has an average-risk project under

Q67: Your firm has an average-risk project under

Q67: Equity is an attractive form of financing

Q68: When estimating a weighted average cost of

Q73: To estimate the market value of a

Q75: Market values require multiplying the _ of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents