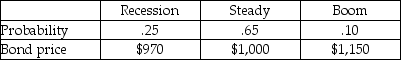

Your investment banking firm has estimated what your new issue of bonds is likely to sell for under several different economic conditions.What is the expected (average) selling price of each bond?

A) $1,000.00

B) $1,007.50

C) $1,040.00

D) $1,100.33

Correct Answer:

Verified

Q28: Over the 50-year period from 1950 to

Q31: A more risky stock has a higher

Q32: Over the 50-year period from 1950 to

Q38: Stocks A,B,C,and D have returns of 5%,15%,30%,and

Q40: Which of the following classifications of securities

Q46: George is considering an investment in Parson

Q47: Given the expected returns and probabilities of

Q49: Explain how the statistical concepts of mean

Q50: If stock A has a greater standard

Q52: Which of the following statements about probabilities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents