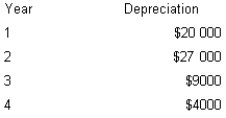

Abco Pty Ltd is considering the purchase of $60 000 in tools. The manager estimates that the tools will generate $25 000 in savings during each year of a four-year life. The tools will be depreciated based on the following schedule.

The expected tax rate is 30 per cent. What is the tax effect of the depreciation in year 3? (Ignore time value of money)

A) $9000

B) $6300

C) $2700

D) $1823

Correct Answer:

Verified

Q60: Projects with a zero or positive net

Q61: A machine will cost $28 000. It

Q62: The manager of Malan Pty Ltd wants

Q63: Wakefield Company management evaluates future projects based

Q64: Charlotte Computer Services is considering purchasing equipment

Q66: If a proposal's profitability index is greater

Q67: Suppose a firm has an asset that

Q68: The profitability index is calculated by:

A) multiplying

Q69: Rogers Company purchased equipment for $30 000

Q70: Abco Pty Ltd is considering the purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents