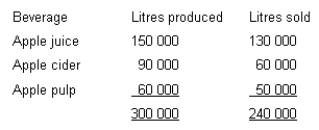

A firm incurs manufacturing costs totalling $240 000 in process 1 to produce the following three beverages emerging from that process at the split-off point.

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the net realisable value method had been used?

A) $120 000

B) $80 000

C) $84 000

D) $91 000

Correct Answer:

Verified

Q42: The joint cost allocation method that ensures

Q43: Consider a situation where an activity-based costing

Q44: Lipex Pty Ltd produces two products (A

Q45: Contribution margin per machine hour can be

Q46: The method under which the relative magnitude

Q48: A firm incurs manufacturing costs totalling $240

Q49: A firm incurs manufacturing costs totalling $240

Q50: An appropriate way to account for by-products

Q51: Lipex Pty Ltd produces two products (A

Q52: The joint cost allocation method that is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents