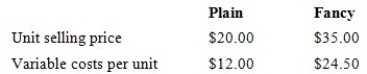

Maxie Pty Ltd makes and sells two types of shoes, Plain and Fancy. Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant. Assume an income tax rate of 20 per cent.

The break-even point for this data is 5000 units in total. How will the calculation of the break-even point change (if at all) if the relative percentages of the products in the mix change from 60 per cent Plain shoes to 40 per cent Fancy shoes?

A) The break-even point in total will not change. The only change will be the relative number of each of the units.

B) Neither the break-even point in total nor the relative number of each of the units to produce at break-even will change.

C) The break-even point will change because the calculation above assumes a constant mix, namely 60 per cent to 40 per cent.

D) The break-even point will be higher.

Correct Answer:

Verified

Q24: Econ Pty Ltd produced and sold 45

Q25: Which of the following are advantages of

Q26: Which of the following assumptions is made

Q27: The total contribution margin is calculated as

Q28: Econ Pty Ltd produced and sold 45

Q30: Cost volume profit analysis is based on

Q31: Maxie Pty Ltd makes and sells two

Q32: Alclear Pool & Spa presently provides a

Q33: Econ Pty Ltd produced and sold 45

Q34: Econ Pty Ltd produced and sold 45

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents