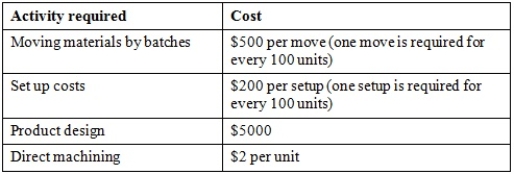

Chelonia Ltd manufactures small robot toys. It plans to introduce a new product, Speedie the robot tortoise. The following activity cost information is available:

It is expected that each unit of Speedie will sell for $23. The direct material cost for unit is $10. Assuming a tax rate of 40%, how many units of Speedie must Chelonia Ltd produce and sell to make an after-tax profit of $12 000?

(For simplicity, assume that you can have partial moves and partial batches - that is, no need to round up the number of batches and the number of moves.)

A) 1000 units

B) 1818 units

C) 4250 units

D) 6250 units

Correct Answer:

Verified

Q86: Which of the following approaches enables management

Q87: Although the cost structure of a firm

Q88: i. Explain how the traditional profit and

Q89: If a firm has $482 500 in

Q90: Which of the following statements about the

Q92: The break-even point in units can be

Q93: i. Explain how cost volume profit (CVP)

Q94: When management runs several CVP analyses with

Q95: Management would prefer a smaller safety margin

Q96: Chelonia Ltd manufactures small robot toys. It

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents