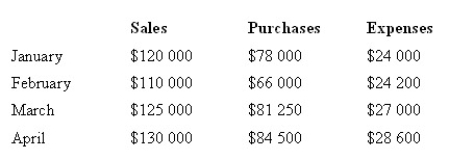

The Grainger Company's Budgeted Profit and Loss Statement reflects the following amounts:

Sales are collected 50 per cent in the month of sale, 30 per cent in the month following sale, 19 per cent in the second month following sale and 1 per cent is uncollectible. The uncollectible accounts are expensed at the end of the year.

Grainger pays for purchases by the fifth of the month following purchase, to take advantage of the 3 per cent discount allowed.

On January 1, Grainger had a cash balance of $88 000 and an accounts receivable balance of $58 000; $35 000 on account will be collected in January with the remaining balance to be collected in February. Grainger had an accounts payable balance of $72 000 on January 1. Invoices are recorded at their gross amount.

The monthly expense figures include $5000 in monthly depreciation. The expenses are paid for in the month incurred.

What is Grainger's expected cash balance at the end of January?

A) $92 000

B) $94 160

C) $87 000

D) $89 160

Correct Answer:

Verified

Q22: People create budgetary slack because

A) their performance

Q23: A budget that includes sales revenue, cost

Q24: The difference between the revenue or cost

Q25: Vebco manufactures a product requiring 0.5 grams

Q26: BeActive Sporting Goods sells tandem bicycles. The

Q28: Lee's Appliances forecasts the following sales figures

Q29: On January 1, Bandy Manufacturing plans to

Q30: Lee's Appliances forecasts the following sales figures

Q31: To communicate budget procedures and deadlines to

Q32: Consider the following statements about budget administration.

i.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents