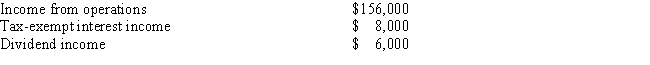

The partnership of Felix and Oscar had the following items of income during the tax year ended December 31, 2014: What is the total ordinary income from business activities passed through by the partnership for the 2014 tax year?

A) $156,000

B) $157,000

C) $162,000

D) $170,000

E) None of the above

Correct Answer:

Verified

Q22: For tax purposes, in computing the ordinary

Q35: Which of the following items must be

Q38: Which one of the following is not

Q42: Barry owns a 50 percent interest in

Q44: Phil and Bill each own a 50

Q48: Wallace and Pedersen have equal interests in

Q53: Under which of the following circumstances would

Q63: Which of the following is a disadvantage

Q64: Owen owns 60 percent of the Big

Q83: Which of the following is true about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents