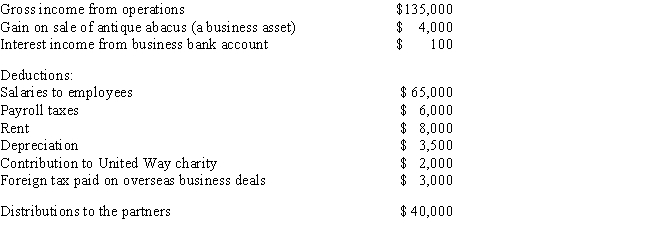

J. Bean and D. Counter formed a partnership. During the current year, the partnership had the following income and expenses:

a. Calculate the net ordinary income.

b. List all of the other items that need to be separately reported.

c. If the partnership is on a calendar year tax basis, when is the partnership tax return due?

Correct Answer:

Verified

Q13: Jack and Jill decided to pool their

Q24: Please answer the following questions:

a.What form is

Q25: Cooke and Thatcher form the C&T Partnership.Cooke

Q33: A partner contributes assets with a basis

Q48: Assuming that a partnership normally has a

Q51: Cypress Road is a partnership with two

Q70: Rochelle owns 40 percent of a partnership

Q70: In December of 2014, Miss Havisham and

Q71: During 2014, Jay is a partner in

Q81: List three advantages of an LLC.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents