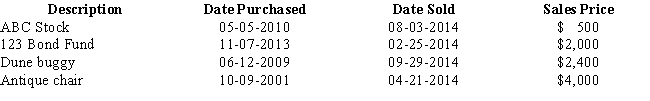

During 2014, William sold the following capital assets:

Calculate the following:

a. Total short-term capital gain/loss realized for tax purposes

b. Total long-term capital gain/loss realized for tax purposes

c. Deductible capital gain/loss

d. The amount and nature (short-term or long-term) of his capital loss carryforward

e. Assuming that William has no capital gain or loss for 2015, how much can he deduct in 2015 and what is the amount and nature of any carryforward to 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Karen received a stock portfolio upon the

Q26: Bev owns an apartment complex she purchased

Q88: Indicate whether a gain or loss realized

Q89: During 2014, Ethel exchanges a machine for

Q90: In 2014, Helen sold Section 1245 property

Q91: After 4 years of life in the

Q94: In October of the current year, Mike

Q95: Dan acquired rental property in June 2004

Q97: Rod had the following loss on business-use

Q98: In 2014, Penny exchanges an investment property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents