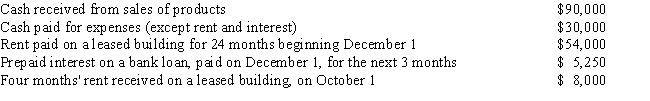

Polly is a cash basis taxpayer with the following transactions during the year:

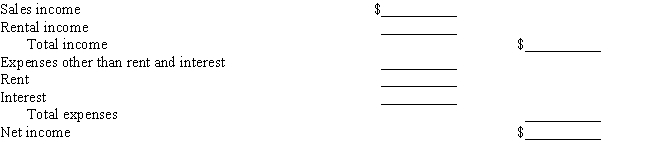

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Q5: To be depreciated, must an asset actually

Q18: If a taxpayer purchases land worth $200,000

Q24: Jerry and Julie are brother and sister.Jerry

Q28: ABC Corporation is owned 30 percent by

Q33: If a loss from sale or exchange

Q72: On January 1, 2014, Ted purchased a

Q74: On September 21, 2014, Jay purchased a

Q75: Calculate the following amounts:

a. The first year

Q77: On June 1, 2014, Cork Oak Corporation

Q108: Mark the correct answer.Section 197 intangibles:

A)Are amortized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents