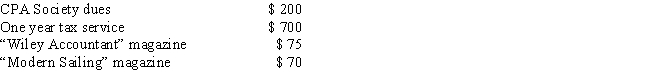

Catherine is a CPA employed by a large accounting firm in San Francisco. In 2014, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

A) $275

B) $345

C) $775

D) $975

E) None of the above

Correct Answer:

Verified

Q77: For 2014, Eugene and Linda had adjusted

Q78: Which one of the following is not

Q81: Sally and Jim purchased their personal residence

Q82: Newt is a single taxpayer living in

Q83: Sherry had $5,600 withheld from her wages

Q84: Charlie is a single taxpayer with income

Q96: Which of the following is not deductible

Q99: Damage resulting from which of the following

Q102: Which of the following is a miscellaneous

Q119: Christine saw a television advertisement asking for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents